SBA loans beyond expectations.

Get the capital your business needs with our streamlined SBA loan process. Fast approvals, competitive rates, and expert guidance every step of the way.

Everything you need to grow your business.

We offer a variety of financing solutions with favorable terms to help small businesses thrive.

SBA 7(a) loans for your business

The most versatile SBA loan program, perfect for working capital, equipment, and business expansion.

- Up to $5 million in funding

- Terms up to 25 years

- Competitive interest rates

SBA 504 loans to fuel your growth

Ideal for purchasing real estate, equipment, and other fixed assets for your business.

- Up to $5.5 million for equipment

- Fixed interest rates

- Low down payments

Business Line of Credit

Flexible funding that allows you to draw funds as needed for managing cash flow, unexpected expenses, or growth opportunities.

- Access funds when you need them

- Only pay interest on what you use

- Revolving credit structure

Term Loans

Traditional business loans with fixed or variable rates, ideal for specific business investments with predictable repayment schedules.

- Lump sum funding

- Predictable payment schedule

- Competitive fixed rates

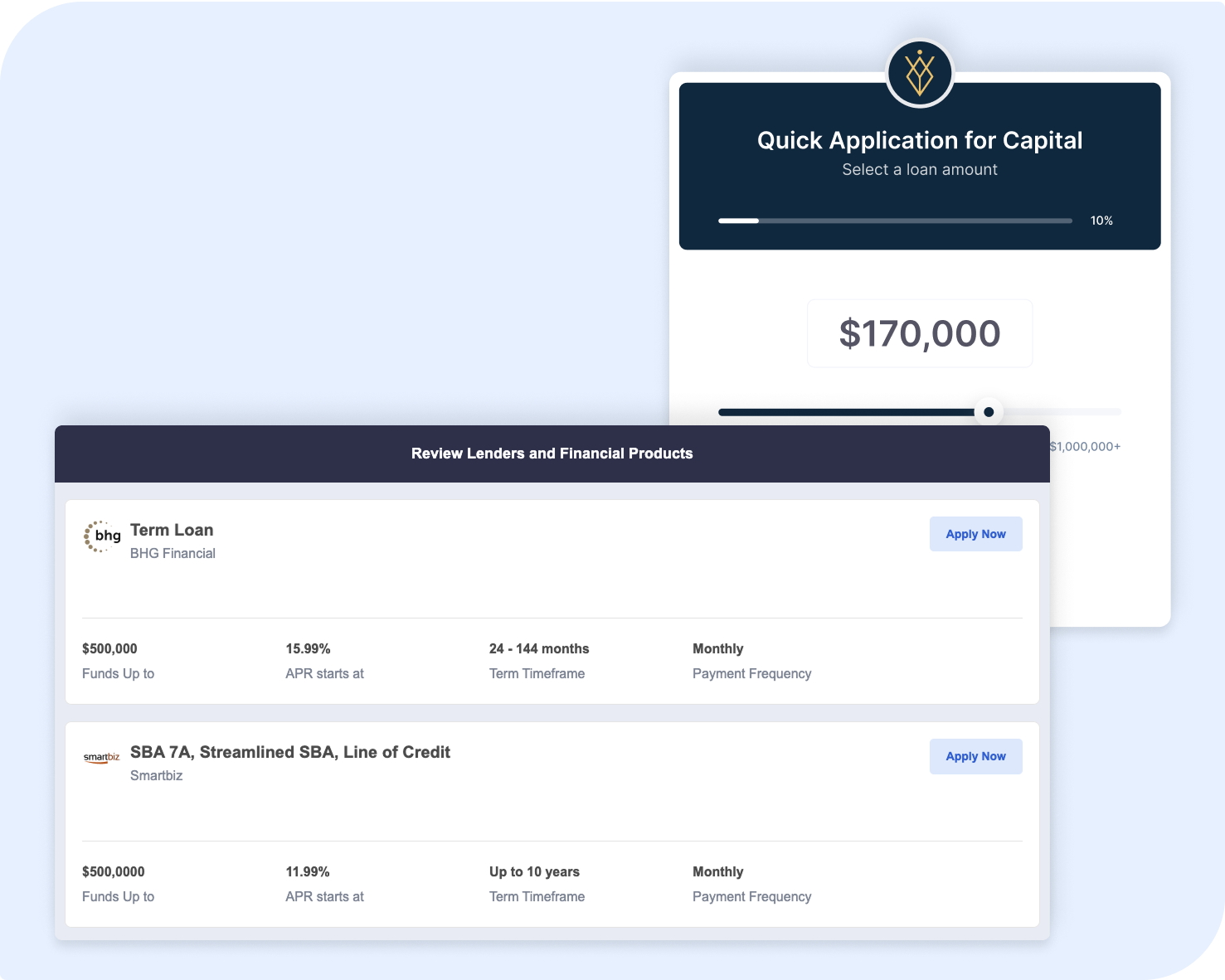

Choose the business funding plan that's right for you

Compare all financing options to find the perfect solution for your business needs.

Bank with confidence

SBA loans are backed by the U.S. government, providing security and peace of mind for your business.

Fast approvals

Our streamlined process means you can get approved quickly and access capital when you need it most.

Competitive rates

SBA loans offer some of the most competitive interest rates available for small business financing.

Calculate your loan

Use our calculator to estimate your monthly payments and see how much you can borrow.

Loan Calculator

Our Simple Process

We've streamlined the SBA loan process to make it as simple and efficient as possible for our clients.

Initial Consultation

We'll discuss your business needs and goals to determine the best financing solution for you.

Application Preparation

Our team will help you prepare and submit a comprehensive loan application with all required documentation.

Underwriting & Approval

We'll guide your application through the underwriting process and work to secure approval.

Loan Closing

Once approved, we'll coordinate the closing process to ensure a smooth and timely funding.

Ongoing Support

Our relationship doesn't end at closing. We provide ongoing support throughout the life of your loan.

Why Choose Waterloo Funding?

- •SBA-backed loans with interest rates as low as 5.5%

- •Get approved in as little as 48 hours with our streamlined process

- •Our SBA specialists will guide you through every step

See why our customers love Waterloo Funding

Join thousands of satisfied business owners who have secured SBA loans through us.

"Waterloo Funding helped me secure an SBA loan to expand my daycare business. Their team guided me through every step of the process, making it smooth and stress-free. I couldn't be happier with the results!"

Sarah Johnson

Owner, Bright Horizons Daycare

"As a tech startup, we needed capital to scale our operations. The experts at Waterloo understood our unique needs and secured us favorable terms on our SBA loan. Their knowledge and dedication were invaluable."

Michael Rodriguez

CEO, TechSpark Solutions

"When I needed financing to purchase new brewing equipment, Waterloo Funding delivered. Their team's expertise in SBA loans saved us time and money. I highly recommend their services to any small business owner."

David Chen

Owner, Pacific Coast Brewing